How does someone get to where they are in a career?

Here is my path: I hope that these lessons will help you but also prove that many times, the path to somewhere isn’t a straight line, it’s littered with curves, peaks and valleys, sunshine and rain.

I am not saying I have made it but rather just sharing where I have come from.

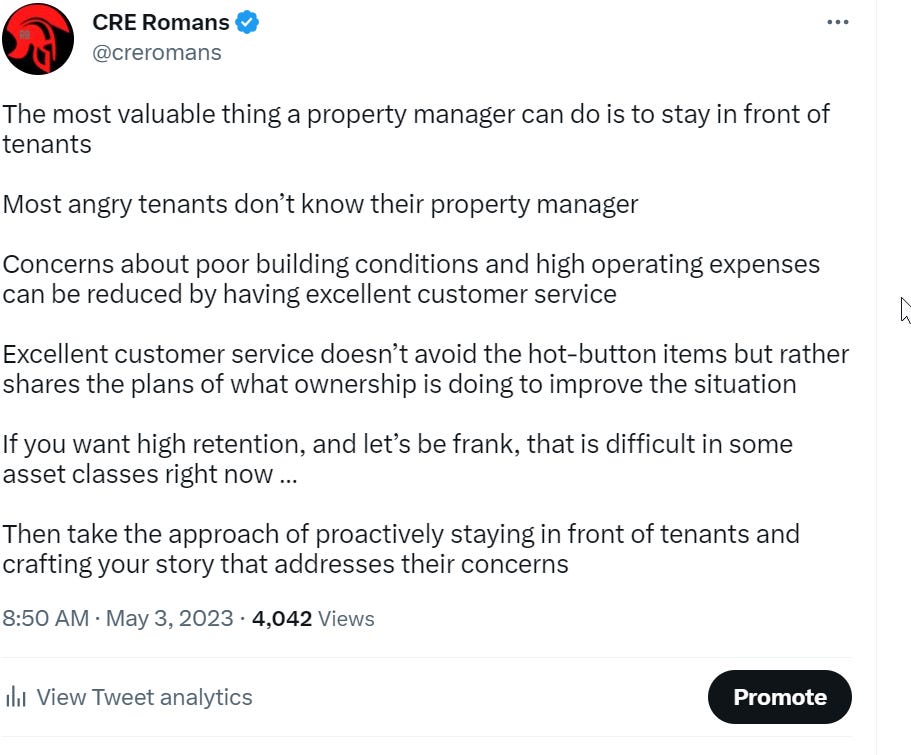

First, of all, I am the CRE Romans Guy on Twitter. Thank you for your readership and interest in my content.

Here is the path that God led me down through my CRE journey.

Before getting into CRE, I attended and graduated from a Big Ten school with a degree in Health Sciences.

In 1996, I sat down with my guidance counselor at said University and told them what I wanted in my ideal career.

The conversation I had was centered around platitudes and feel-good words. Now, by no fault of their own, there are only so many options that a particular University can place you in.

I told the counselor that I wanted to have a career that didn’t require me to be at a desk all day long but rather something that allowed me to make a difference, be outdoors, talking with people, etc.

The only logical program within the particular school I was talking to was Health Sciences.

In hindsight, I’d attribute this path to have been set several years prior. You see, my good friend at the time had an older sibling who attended this University.

My friend and I would visit the older sibling on campus while we were in High School. Needless, to say, the times spent on the campus while still in HS were all the recruiting I needed, there was no doubt this is where I was going to college.

The conversations as home with my parents was focused on that particular college because let’s be honest, I had no clue what I wanted to do for a career. Frankly, the letters CRE didn’t exist in my vocabulary at the time.

My parents were hard working folks, but never attended College. So, their guidance was limited to the information they were being given from other members of the community.

This environment led my parents to suggest that I talk further with the parents of my friend and his older sibling.

So, I sat down with them, told them my ideas for what I’d like to do when I grow up. They were also alums of this college and donors. They were able to set up a meeting for me rather quickly with this particular guidance counselor.

So, that is how I entered into the Health Science program in 1996 at a very fun college :)

I graduated with my BS in Health Sciences then got a job at a consulting firm which ended up being a terrible experience for me.

All of the ideas I had about getting outside, talking with people and not being at a desk were not what they were planned to be.

Instead, I was working outside the office in dark factories, dirty office buildings, talking with people who were miserable because they hated their jobs. It wasn’t what I had planned.

I was 24 years old and after 10 months at the job I had a degree in I resigned and took a new job with a Subprime mortgage company in late 2001.

As you will see, this became the catalyst for my love for business development, negotiating, deals and the world of CRE.

I say it was the beginning because this was a long journey full of several different types of work before finally landing on my passion for leasing space.

A Recent Premium Article

2001 - 2003

As an Account Executive at a Subprime mortgage company, I learned that the telephone was where people made over $10,000 per month.

At this job, I made at least 100 cold calls per day to a pre-built database. At the time, I didn’t appreciate the fact that the company was automatically delivering leads to call on demand.

All I had to do was call them, ask them about a refinance and explain that we can help them save money each month by doing business with us.

The setup was one where the AE would generate the lead, complete a loan application and hand off the loan app to the “Closer”.

At the time, I loved the high-volume outbound call method but found it interesting that the Closers were making all the money.

The folks would get prequalified leads from the AEs, run a credit report showing all of the debts they could consolidate for the client and close them.

These were the people making the money. The AEs were also making money but not as much as the Closers.

I had to learn how to close!

What is funny looking back though is that closing a refi at a historic low rate with no income verification that saved someone $600/month wasn’t really closing. It was simply talking!

The most important lesson I learned here was the value that getting on the phone and talking to people has in the business world.

I also learned that I rather enjoyed the process of talking with people I didn’t know and wanted to learn how to become better at that.

2003 - 2005

My father was always in real estate. As a young kid, I remember working summers with him in his flips and admiring the way he was able to take care of his tenants. I especially admired his empathy when things were hard for a few particular families.

I found that being in RE was a way to make money but also show grace and help others.

The subprime mortgage company was starting to have issues internally. I am sure you know where that ended up.

Luckily, my dad had asked me to come to work with him in 2003. At the time, he was running a real estate development, construction and financing company solely focused on helping churches across the US finance and build new or expansion facilities.

At the time, I was naïve as heck, and was only focused on the money and glamour of being a developer. What a joke!

The phone skills I had acquired gave me a good foundation to hit the phones for my dad and start generating interest from churches to talk with us about these services.

I was able to find a few deals but frankly that fact that I didn’t have a strong CRM or the knowledge of how to build one hurt not only me but the entire company.

My dad was working off old files he had from a previous job. These were literally the only contacts we had, and we never built a list to further grow the database.

THIS METHOD IS FLAWED!

At the time, I didn’t even know this was a thing because the mortgage company always delivered the leads to me.

Big lesson learned here was that phone skills must be matched with a strong database.

Another important lesson learned is that your dad in Dad mode is different than your dad in work mode.

Working with family was not for me and after a few years of giving it a go, I decided to pursue another avenue. One that I had been interested in now for a few years…

2005 - 2007

In 2005, I sent the owner of a local brokerage an unsolicited email. He responded that he admired this approach and invited me in to talk with him and the Managing Broker.

This was not a difficult interview, as you might imagine. The company is still around but in 2005 it was still in its infancy stage trying to grow the brokerage team.

They offered me the 100% commission position on the spot of course and told me that I needed to get my license and purchase Act!. I had no idea that I needed a license to be a broker, and also didn’t know what it meant to have a CRM.

I should have asked more questions, but I didn’t know what I didn’t know.

All I did was shake my head yes and I did the things they told me to do to get started.

After passing the RE exam and purchasing the CRM I was ready to get started. So, I was working through the yellow pages. Yes, I would search the yellow pages for a certain industry, Accounting for example, and call all of them asking if they were thinking about renewing their lease.

This brokerage was an opportunity for me to practice being a generalist in the market. There really wasn’t any formal training other than the owner bragging about how smart he was when it came to prospecting, marketing and advertising.

Again, I had no idea that there was a systematic approach that should be taken here. I thought you were just in a numbers game business and if you talk to enough people, someone will eventually do business with you.

I mostly piled up debt at this job and learned that the mentorship and long-term prospects weren’t what I was looking for.

So, one morning while attending a continuing ed seminar I spoke with a representative from a State University about them RE and Construction management program.

I quickly enrolled and began taking classes while looking for a way to get out of the town I was in and relocate to a bigger city just 45 minutes North. That’s just what I was able to do.

2007 - 2009

Although I enjoyed brokerage, I was also very interested in exploring other areas of CRE.

While taking a course in my graduate program I met a gentleman who worked for a construction management firm specializing in healthcare projects.

The company took a holistic approach to helping healthcare systems and hospitals strategically build hospitals and outpatient MOBs.

This excited me because the company had a position which would allow me to utilize my existing brokerage skills to evaluate real estate opportunities as well as help me grown and learn more about construction and project management.

I got the job and started working under senior project managers on some rather significant jobs across the country. Anything from an expansion of an existing unit of a hospital, real estate planning, space planning and programming, working with vendors, GCs and also a $200MM ground up project.

This was very cool and being young and single it provided an opportunity for me to travel across the country. Win!

However, the GFC was wreaking havoc on many of the projects the company was working on and in 2009 I was laid off from this job.

In hindsight, the best thing that could have happened to me because there was more that I had yet to explore.

2009

Another connection I had made in my graduate program told me about a Senior Property Manager who was branching out to start his own property management company.

This gentleman was looking for property managers with and without experience to jump in with him and manage his portfolio of properties.

I had never been a property manager before so as I was in the growing and learning stage of my career, this sounded like a logical move to make.

I was wrong!

Mostly it was wrong for me because of my personality and skillset. My skillset is more geared toward finding and doing deals, not creating budgets, fixing problems and dealing with angry tenants.

The skillset of a property manager is the complete opposite of those of a broker. This is a good thing because without the property managers there would be very low tenant retention.

The lesson I learned by working as a property manager was that you need to always “think like an owner”. I admire this philosophy and also see how it applies to brokerage.

However, as I mention earlier, part of my journey was to identify the things I enjoy doing but maybe even more importantly, the things I do not enjoy doing.

I only lasted about 11 months as a property manager. Just enough time for me to develop a high-level understanding and a much deeper-rooted respect for the work a property manager does day in and day out.

One sunny summer afternoon though, my boss at the PM company invited me to play golf and this is where I met my mentor and partner who I would be with for the next 10 years….

2010 - 2020

Meeting my mentor was a complete fluke. I was on the practice putting green with my PM boss when “Terry” walks up and shakes my bosses’ hand.

He introduces me to Terry, and we began to chat. I asked him about his business and my PM boss mentioned that I had a knack for marketing, prospecting and new business development. Funny he didn’t mention property management.

At that point, Terry asked if I’d be up for discussing his current prospecting and new business development plans.

I had that meeting with Terry and then joined his firm in 2010 as a junior broker.

More importantly though, I was able to negotiate with Terry to pay me $3,000 per month to manage the CRM, email marketing, social, SEO, blogging, video, etc. for the company.

He agreed so long as I agreed to make cold calls to his database and turn over any deals I found. He’d pay me a small percentage of the commission if I found a deal.

So, I did that exact thing for 2 years with Terry.

Terry had a very robust CRM with thousands of tenants and lease expirations. This firm was focused solely on tenant rep work.

What Terry taught me was where it all began to click.

Good data makes all the difference and when you match that with a strong ability to close calls and other prospecting efforts for face-to-face meetings, you are going to be successful.

One day Terry said “I think it’s time to take off your training wheels”

I was terrified. I was recently married, and we were thinking about to have my first child. My wife was working at the time, but we needed that $3,000 I was making.

Terry graciously gave me time to think about this proposition and after several days of meddling it over I decided to take the leap.

Crazy thing then happened, just a few weeks later I landed a 60,000 SF, 10-year office lease which paid out a $349k commission.

That’s like hitting a homerun in your first at bat frankly and it took 18 months for that deal to actually close and pay out.

In the meantime, I hammered the phones, 100 calls a day type thing and generated several singles and doubles along the way.

Things were going well; I was enjoying the work I was doing and appreciated the fact that I had a senior broker who was giving me undivided training on a daily basis.

This was awesome. But I felt there was a need to improve beyond just the skillset of my past experiences and Terry’s.

So, I started investing heavily in sales training, mainly cold call training. Over the course of the next few years, I found out exactly how to make cold calls.

I learned that cold calls are a mechanical process that anyone can learn. It just takes time, practice, patience and discipline to get there.

I continued to make 80-100 calls every day and loved the work I was doing; however, an opportunity came along that met my long-term goals…..

2020 - Today

One afternoon while making calls, I received a LinkedIn message from a recruiter for a position with a REIT that buys, leases and manages medical office buildings.

From early on in my career, my goal was to work with an organization that had the 3-tiered approach of buying, leasing and managing.

I took this position and started working on 2.5M SF across 3 states. The company has continued to grow, and I now oversee the leasing of 4M SF across 4 states and manage a team of 11 brokers and 100s of tenants.

My job is to develop marketing and prospecting plans for my brokerage teams to execute on daily. This allows me to utilize all of my previous years of experience and training to further grow the portfolio I manage.

The focus of my position is net new absorption which means always renewing current tenants and always finding new deals. We work within underwriting guidelines that are required to keep growing year over year.

The role I have now is a culmination of several years of trial and error and it’s perfect for me at this stage in my life.

Final Thoughts

As you can see, there is no straight-line path, and your specific personality and preferences will and should play a huge role in the lane you find yourself in.

I hope this has been entertaining as well as helpful. But more than anything I hope you see that there is no one size fits all path.

The main thing is to realize you need to just start and that this journey never ends.

When you are ready, I can help you in a few ways:

Cold Call Training - My entire cold call training method documented in short videos.

My entire prospecting library (Free for paid members) - All of the prospecting and marketing templates, scripts, videos, reports, follow up plans, etc. at no extra cost when you become a paid member.